Growth strategy, strengths

The strategy of the F.I.L.A. Group aims to combine organic growth, by strengthening its brand portfolio, with strategic and high value-added acquisitions in the medium to long term, in the School and Fine Arts segment, adopting an increasingly sustainable approach.

Since 1994, F.I.L.A. has embarked on a quest to internationalise its business thanks primarily to a prudent M&A strategy, which has led to some major acquisitions. The F.I.L.A. Group’s growth strategy seeks to combine organic growth with acquisitions and is based on three fundamental pillars.

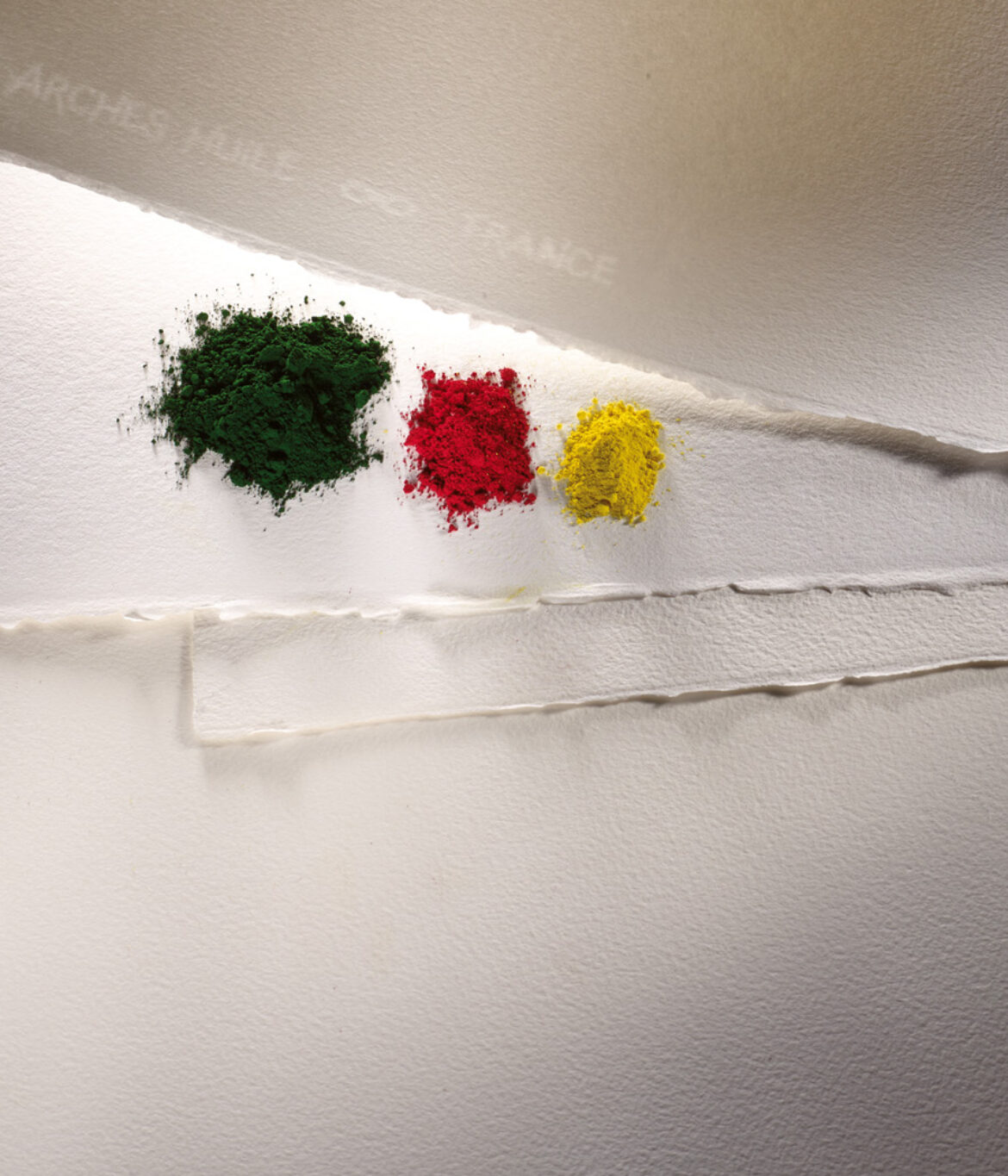

School and Fine Art & Crafts

Focus on “colour-related” business (School and Fine Arts).

Strategic acquisition

Acquisition of companies with vertically integrated production, strategic and global brands, and a regional presence in the target market.

Internazionalization

Since 1994, the constant international growth and long-range geographical expansion, with a significant presence today not only in Europe but also in North America, Mexico, and India, has been accompanied by market consolidation through the expansion of the product range from the School segment to that of Fine Arts, allowing us to reach more than 150 countries worldwide.

Global presence

Global presence driven by organic growth and acquisitions that consolidate the Group's presence in mature countries and drive growth in developing ones. Growth in “business scale” from local to global player.

Skills and expertise

Proven production expertise supported by a tightly controlled supply chain and vertical integration. Specialised and interchangeable production sites.

Brand Building

The Group considers its brand portfolio to be a strategic asset and is committed to making continuous investments in marketing and communication. These investments seek to strengthen the recognition and reputation of its iconic and distinctive brands in key markets and introduce them to new high-potential geographic areas.

Product Portfolio

Comprehensive product range, both in terms of depth and breadth, and a price and quality point that caters to the needs of diverse markets and consumer segments.

Global Supply Chain

Over the years, the Group has significantly expanded and consolidated its skills and expertise in the supply chain to support time to market and customer service.

Digital Transformation

The Group seeks to enhance its agility, capacity, and speed in making strategic business decisions. To achieve this, it plans to implement SAP across all global companies and centralise capabilities for better oversight. This approach will allow Group companies to concentrate on their core business and development.

Solid track record of acquisitions

The Group has taken an active role in the industry consolidation process with a solid track record of acquisitions. The Group has completed over 14 acquisitions since 1994. These transactions have significantly strengthened its brand portfolio and extended its geographical reach.

Strong generation of cash flows

Significant cash generation is one of the strengths of the FILA Group. Over Euro 120 million of cash generated in the last 3 years and increasing focus on working capital management.

Management Team

The leadership exercised since the 1960s, first by Alberto Candela and then by Massimo Candela, has translated into a stable and coherent long-term vision, allowing for the execution of a growth strategy that has led to the Group's current make-up.